A Mid-Sized Australian Medical Devices R&D Company had a requirement for a Global VP of ...

A Mid-Sized Australian Medical Devices R&D Company had a requirement for a Global VP of ...

By i-Pharm Consulting 03 July, 2023

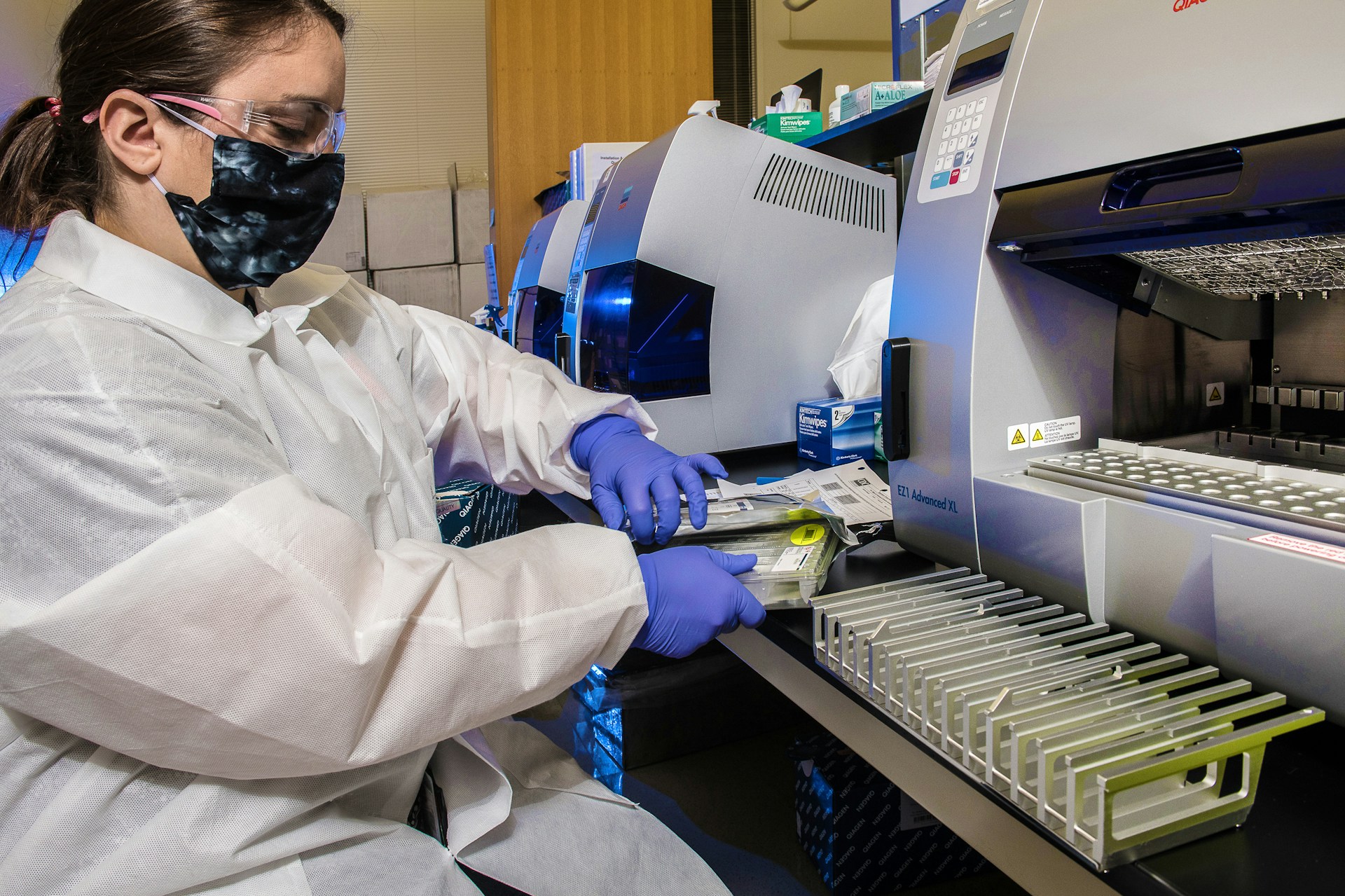

The life sciences industry brings together brilliant minds to tackle some of the biggest cha...

By i-Pharm Consulting 01 June, 2023

Our client, a global CRO employing around 1,000 people had grown organically since its incep...

By i-Pharm Consulting 01 June, 2023

The Future of Data Analytics in the Life Science Industry: What's Next?

16 May, 2023

The Future of Data Analytics in the Life Science Industry: What's Next?

16 May, 2023

By i-Pharm Consulting 16 May, 2023

Within medical jobs in rare diseases, employers are crucial in shaping the career paths of y...

By i-Pharm Consulting23 May, 2024